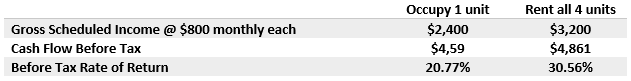

House-Hacking Rental Property2/3/2020 House-hacking refers to buying a multifamily property on an owner-occupied mortgage, living in one unit and renting the others. If you're thinking about becoming a rental mogul, starting early is an advantage. Not only will you have longer to accumulate a larger portfolio, you can increase the leverage on the first acquisitions if they are owner-occupied. Leverage is the use of other people's money to finance an investment. The higher the loan-to-value, the greater the leverage which can increase the yield. A $200,000 rental property with an 80% LTV at 4.5% for 30 years producing a 16.88% before-tax rate of return would increase to a 23% return on investment by increasing the mortgage to 90%. A typical down payment on an investor property in today's market is 20-25% but, in some cases, a higher loan-to-value is possible. Owner-occupied, multi-unit properties, two to four units, allow a borrower to occupy one of the units and rent the others out. The cash flows from the rental units subsidize the cost of housing for the unit occupied by the owner. VA will guarantee 100% of the mortgage for eligible veterans, while FHA will loan up to 96.5% for qualifying borrowers. Consider a four-unit property was purchased as owner-occupied and the other three units were rented for $800 each. If an FHA loan was obtained, the owner could live for roughly $355 a month after collecting the rent and paying the expenses. Assume the owner lived in it for two years and then, rented out the fourth unit for the same $800 per month. The cash flow would rise to $4,800 a year with a before-tax rate of return of 30% based on a 2% appreciation. Rental properties offer the investor to borrow large loan-to-value mortgages at fixed interest rates for up to 30 years on appreciating assets with tax advantages and reasonable control that many other investments don't enjoy.

Some people consider rental properties the IDEAL investment with each letter in the acronym standing for a benefit it provides. It provides income from the rent which many investments do not have. Depreciation is a non-cash deduction from income that increases cash flow. Equity buildup occurs as each payment is made by reducing the principal owed. Appreciation happens over time as the value of the property increases. L stands for leverage that was explained earlier in this article. You may be able to buy another four unit as an owner-occupant before you need to start using a normal investor's down payment. In the meantime, you could have eight units that are increasing in value while the mortgage balance is decreasing with every payment made. If there is sufficient equity in the properties by the time, you're ready to buy more, you may be able to take cash out of the existing ones to use for the down payments. This can be a great way to turbocharge your net worth by becoming an owner and a real estate investor at the same time. To learn more about rental properties, download the Rental Income Properties guide and/or contact me at to schedule an appointment to meet to discuss the possibilities.

0 Comments

Buy Your Retirement Home Now11/4/2019 Maybe you're not ready to move into it but that doesn't mean that you shouldn't take advantage of the present opportunities to acquire the home you want to live in during retirement. The combination of the low mortgage rates, high rental rates, positive cash flows and tax advantages can help you get it paid for by the time you're ready to move into it.

Your tenant could literally buy your retirement home for you. One idea would be to finance it with a 15-year loan that will have a lower rate than a 30-year loan and it will obviously be paid for in half the time. With every monthly rental check from your tenant, you make the payment on the mortgage which includes a portion that reduces debt and builds equity. Even if you don't have the home paid for by the time you retire, your equity will be larger. Consider you sell your current home which could be paid for by then when you are ready to move into this retirement home. Taxpayers can exclude up to $500,000 of tax-free gain for a married couple. That profit could be used to fund your retirement. Even if you don't retire to this home, it could be a placeholder to control the costs of the home you do move into. For example, you could buy a home in a destination location now, rent it out and build equity in it until you're ready to use it as your principal residence. That home would have kept pace with other homes in the area so that you would not be priced out of the market you want to retire to. With home prices and mortgage rates certain to rise, this may be one of the best decisions you can make. We want to be your personal source of real estate information and we're committed to helping from purchase to sale and all the years in between. Contact us if you'd like to talk about the idea or if you need a recommendation of real estate professional in another city. AuthorRead helpful articles and real estate resources shared on behalf Realtor® Broker, BIC Jennifer R. Rhodes of Premier Island Properties LLC Archives

June 2020

Categories

All

|

|

RB-22237

|

|

RSS Feed

RSS Feed