Convenience at a Cost5/11/2020 The convenience of selling your home without the hassle of getting it ready, putting it on the market, showings, open houses, negotiations and repairs comes at a cost ... a significant part of your equity.

The companies, referred to as iBuyers, that buy homes from sellers are for-profit organizations. They expect to make a profit from sellers who are willing to discount the proceeds they'll realize as an alternative to the conventional method of selling a home for people who need a quick sale. The promotions for these companies generally state that you can receive a cash offer in a few minutes after putting your address online. The discount can be between 10 to 18% compared to normal selling costs from 6 to 9%. The cost to a person with a $100,000 equity could be as much as ten thousand dollars. Even after you have accepted an offer, there can be contingencies in the contract that allow the company to inspect the home to discover the condition and reassess the offer to possibly make even more deductions. If the seller isn't willing to accept them, the buyer can withdraw from the sale without penalty. This appears on the surface to be a friendly, accommodating service but it can be an adversarial situation. The seller wants to maximize their proceeds and the buyer wants to buy it as cheap as possible. Compare this to working directly with a real estate professional acting as your agent. They have to put your interests above their own. They have a fiduciary duty of care, integrity, honesty and loyalty in their dealings with you. Other duties include confidentiality, disclosure, obedience and accounting to the seller. In this traditional model, your agent will provide you with the facts of what homes have sold for in the area and their opinion and recommendations on what the most likely sales price will be. Your agent will provide you an estimate of the sales expenses based on different sales possibilities. They can advise you on work to be done prior to putting the home on the market, staging so your home will show at its best and estimate the time it will be on the market. Based on low inventories in some price ranges, it could be surprisingly short. As an owner, you made an investment in your home in cash and maintenance. You are entitled to maximize your proceeds based on the risk taken to purchase a home instead of renting. The convenience of a quick offer has a cost to it. You need to compare the two alternatives to see which one benefits you the most based on your individual situation. For more information, download the Sellers Guide.

0 Comments

Why have a Mortgage during Retirement?3/16/2020 You don't have to watch TV for long before Tom Selleck, Henry Winkler or Robert Wagner will tell you why seniors should consider a reverse mortgage. However, there are a seniors who are resisting the conventional wisdom of having their home paid for and opting for a mortgage with payments on their home.

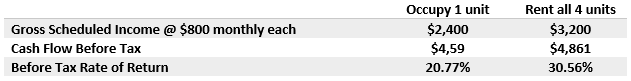

In some cases, seniors will downsize into a smaller home and have a large amount of equity to pay cash for the new home. In other situations, they may have their home paid for and decide to do a cash-out refinance which will require making payments. The logic behind either of these examples could be motivated by the fact that since mortgage rates are so low currently, the owners can reinvest the money at a higher yield and make money on their equity. This will give them more money for their retirement income. A common question that is asked by owners considering such a strategy is whether they'll be able to qualify for the new mortgage since they may no longer be employed. The Equal Credit Opportunity Act prohibits discrimination against borrowers based on age. All borrowers, whether they are working or not, need to show that they have good credit, reasonable debt and enough stable income to repay the mortgage. Lenders cannot base their decision on loan term based on an applicant's life expectancy, so a 30-year loan is possible regardless of the borrower's age. Fannie Mae, one of the largest purchaser of mortgages on the secondary market, is concerned on income that is stable, predictable and likely to continue. Retirees' income can come from Social Security, pensions, or distributions from retirement accounts like IRAs, 401(k)s, Keogh or other plans. Lenders will analyze these sources to estimate how long it will last. Other investments can be considered like stocks, bonds, mutual funds and annuities. Based on the type and the volatility of the investment, lenders may be restricted from considering 100% of the income. Getting the facts as it pertains to you as an individual is important to be able to know if you are eligible and how much you can borrow. A trusted mortgage professional who understands this type of borrower is very important to help you determine the right mortgage vehicle and provide information to decide if this option is right for you. Call me at if you would like a recommendation. House-Hacking Rental Property2/3/2020 House-hacking refers to buying a multifamily property on an owner-occupied mortgage, living in one unit and renting the others. If you're thinking about becoming a rental mogul, starting early is an advantage. Not only will you have longer to accumulate a larger portfolio, you can increase the leverage on the first acquisitions if they are owner-occupied. Leverage is the use of other people's money to finance an investment. The higher the loan-to-value, the greater the leverage which can increase the yield. A $200,000 rental property with an 80% LTV at 4.5% for 30 years producing a 16.88% before-tax rate of return would increase to a 23% return on investment by increasing the mortgage to 90%. A typical down payment on an investor property in today's market is 20-25% but, in some cases, a higher loan-to-value is possible. Owner-occupied, multi-unit properties, two to four units, allow a borrower to occupy one of the units and rent the others out. The cash flows from the rental units subsidize the cost of housing for the unit occupied by the owner. VA will guarantee 100% of the mortgage for eligible veterans, while FHA will loan up to 96.5% for qualifying borrowers. Consider a four-unit property was purchased as owner-occupied and the other three units were rented for $800 each. If an FHA loan was obtained, the owner could live for roughly $355 a month after collecting the rent and paying the expenses. Assume the owner lived in it for two years and then, rented out the fourth unit for the same $800 per month. The cash flow would rise to $4,800 a year with a before-tax rate of return of 30% based on a 2% appreciation. Rental properties offer the investor to borrow large loan-to-value mortgages at fixed interest rates for up to 30 years on appreciating assets with tax advantages and reasonable control that many other investments don't enjoy.

Some people consider rental properties the IDEAL investment with each letter in the acronym standing for a benefit it provides. It provides income from the rent which many investments do not have. Depreciation is a non-cash deduction from income that increases cash flow. Equity buildup occurs as each payment is made by reducing the principal owed. Appreciation happens over time as the value of the property increases. L stands for leverage that was explained earlier in this article. You may be able to buy another four unit as an owner-occupant before you need to start using a normal investor's down payment. In the meantime, you could have eight units that are increasing in value while the mortgage balance is decreasing with every payment made. If there is sufficient equity in the properties by the time, you're ready to buy more, you may be able to take cash out of the existing ones to use for the down payments. This can be a great way to turbocharge your net worth by becoming an owner and a real estate investor at the same time. To learn more about rental properties, download the Rental Income Properties guide and/or contact me at to schedule an appointment to meet to discuss the possibilities. Take the Standard Deduction & the Home1/21/2020 Now that the standard deduction is increased to $12,200 for single taxpayers and $24,400 for married ones, many homeowners are better off with the standard deduction than itemizing their deductions to write off their mortgage interest and property taxes. There was some speculation that without the tax advantages, homeownership is not the investment it once was.

By looking at the other benefits, you can see that homeownership is still one of the best investments people can make. A $275,000 home financed with a 4.5%, 30-year FHA loan would have an approximate total payment of $2,075. The difference in the value of the home and the amount owed on the mortgage is called equity. Two things cause equity to increase: the home appreciating in value and the principal loan balance being reduced with each payment made on an amortizing loan. In this example, if the home were appreciating at 2% annually, the value would increase by $5,500 the first year which would be $458.33 per month. At the same time, with each payment made, an increasing amount would reduce the unpaid balance which would average $363.00 a month in the first year. The homeowner's equity would increase over $800 a month. Instead of paying rent, the homeowner is building equity in their home. It becomes a forced savings and lowers their net cost of housing. In seven years, the homeowner in this example would have $80,901 in equity instead of seven years of rent receipts. This example doesn't consider tax advantages at all. If the homeowner would benefit from itemizing their deductions, it would lower their cost of housing even more. The IRS recommends each year to compare the standard and itemized deductions to see which would benefit you more. Items such as substantial charitable donations, mortgage interest, property taxes and large out-of-pocket medical expenses could increase the likelihood of itemizing deductions. You can see the benefits using your own numbers without tax advantages by using the Rent vs. Own. Looking to buy your first home? Already own a home? Call Jenni today to see what advantages homeownership can bring you. Reverse Mortgage1/13/2020 Reverse mortgage loans are like traditional mortgages that permits homeowners to borrow money using their home as collateral while retaining title to the property. Reverse mortgage loans don't require monthly payments.

The loan is due and payable when the borrower no longer lives in the home or dies, whichever comes first. Since no payments are made, interest and fees earned are added to the loan balance each month causing an increasing unpaid balance. Homeowners are required to pay property taxes, insurance and maintain the home, as their principal residence, in good condition. Reverse mortgages provide older Americans including Baby Boomers access to their home's equity. Borrowers can use their equity to renovate their homes, eliminate personal debt, pay medical expenses or supplement their income with reverse mortgage funds. Homeowners are required to be 62 years and older and meet the following requirements:

Payouts are based on the age of the youngest spouse. The younger the age, the less money can be borrowed. Reverse mortgages offer two terms ... a fixed rate or variable rate. Fixed rate HECMs have one interest rate and one lump sum payment. Variable rate loans offer multiple payout options:

Traditional reverse mortgages, also called Home Equity Conversion Mortgage, HECM, are insured by FHA. There are no income limitations or requirements and the loan funds may be used for any purpose. The borrower must attend a counseling session about the HECM, its risk, benefits, and how much can be borrowed. The final loan amount is based on borrower's age and home value. FHA HECMs require upfront and annual mortgage insurance premiums but can be wrapped into the loan. Proprietary HECM loans are not federally insured. Lenders create their own terms, including allowing loan amounts higher than the FHA maximum. Proprietary HECMs don't require mortgage insurance (upfront or monthly), which may result in more funds available. Proprietary reverse mortgages typically have higher interest rates than FHA HECMs. Advantages

Disadvantages

More information is available about reverse mortgages from the Consumer Financial Protection Bureau or Federal Trade Commission or HUD.gov. Questions? Prefer to discuss further? Give Jenni a call at (808) 345-6192 Mortgage interest paid on your principal residence is deductible today as it was in 1913 when 16th amendment allowed personal income tax. The 2017 Tax Cut and Jobs Act reduced the maximum amount of acquisition debt from $1,000,000 to $750,000.

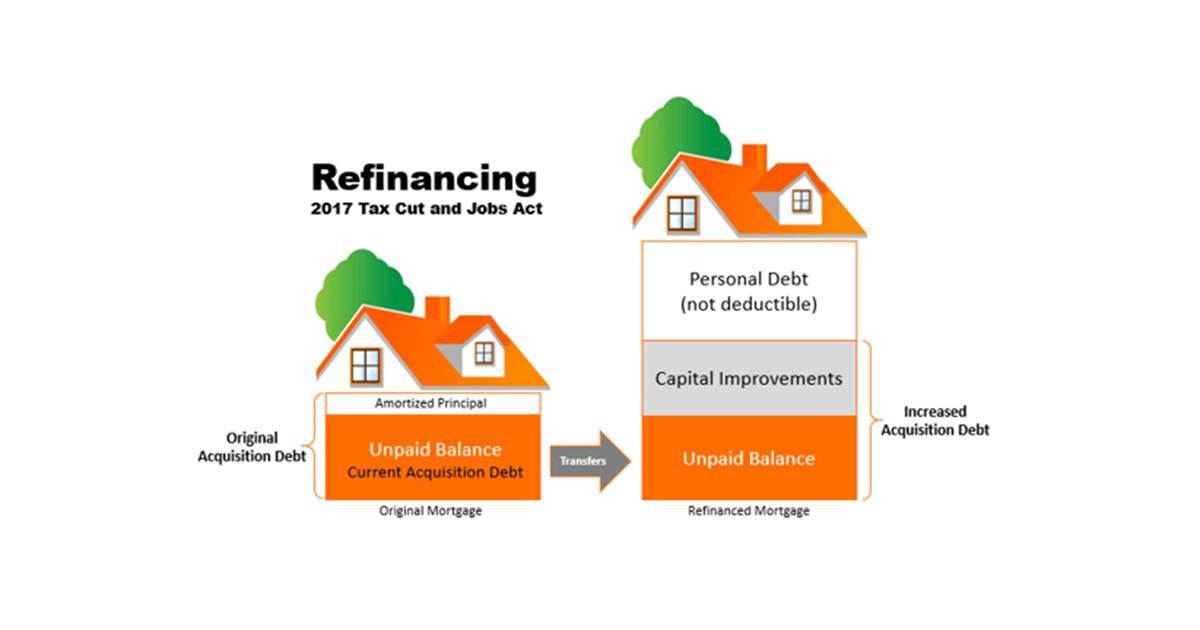

Acquisition debt is the amount of debt used to buy, build or improve a principal residence, up to the maximum amount. A common misunderstanding among taxpayers is that you are entitled to that much debt even if you refinance a home during your ownership years. Acquisition debt is a dynamic number that changes over time. It decreases with normal amortization as the principal amount of debt is reduced. The only way to increase acquisition debt after a home is purchased is to borrow additional funds that are used for capital improvements. Assume a person buys a home with a new mortgage and after the home has enjoyed significant appreciation, refinances the home for much more than is currently owed. Let's also say that the refinance amount is less than $750,000 which might lead the borrower to an erroneous conclusion that all the interest will be deductible. The current acquisition debt is transferred to the new mortgage. Only the portion of the funds used to pay for new capital improvements can be combined to equal the increased acquisition debt. The interest on that part of the mortgage is deductible as qualified mortgage interest. The remainder of the refinanced mortgage is attributed to personal debt and the interest paid on that is not deductible. Lenders are not generally concerned with making a homeowner a fully tax-deductible loan. Lenders are interested in making a loan which will make a profit and be repaid according to the terms. The annual statements that most lenders issue to borrowers indicate how much interest was paid in a calendar year as they are required to do by federal law. Part of the confusion may be because homeowners believe they can deduct interest on debt up to $750,000 and this annual statement shows the interest paid for the year. It is up to each homeowner to keep track of their acquisition debt and only deduct the qualified mortgage interest. Your tax professional can be very helpful in determining this amount. It is important to notify them that you have refinanced a home during the tax year for which the taxes are being reported. For more information, see IRS Publication 936 and Homeowners Tax Guide. Home equity debt has not been allowed since the beginning of 2018. Buy Your Retirement Home Now11/4/2019 Maybe you're not ready to move into it but that doesn't mean that you shouldn't take advantage of the present opportunities to acquire the home you want to live in during retirement. The combination of the low mortgage rates, high rental rates, positive cash flows and tax advantages can help you get it paid for by the time you're ready to move into it.

Your tenant could literally buy your retirement home for you. One idea would be to finance it with a 15-year loan that will have a lower rate than a 30-year loan and it will obviously be paid for in half the time. With every monthly rental check from your tenant, you make the payment on the mortgage which includes a portion that reduces debt and builds equity. Even if you don't have the home paid for by the time you retire, your equity will be larger. Consider you sell your current home which could be paid for by then when you are ready to move into this retirement home. Taxpayers can exclude up to $500,000 of tax-free gain for a married couple. That profit could be used to fund your retirement. Even if you don't retire to this home, it could be a placeholder to control the costs of the home you do move into. For example, you could buy a home in a destination location now, rent it out and build equity in it until you're ready to use it as your principal residence. That home would have kept pace with other homes in the area so that you would not be priced out of the market you want to retire to. With home prices and mortgage rates certain to rise, this may be one of the best decisions you can make. We want to be your personal source of real estate information and we're committed to helping from purchase to sale and all the years in between. Contact us if you'd like to talk about the idea or if you need a recommendation of real estate professional in another city. 35% of respondents, in a recent annual Gallup poll that dates back to 2002, identified real estate as the best long-term investment option compared to 27% who identified stocks.

The top choices included real estate, stocks, savings accounts and gold. Even with the remarkable prices of the different U.S. stock indices recorded in 2019 through April and May, homes have the highest confidence in the minds of the respondents. This seems to be based on the stability of the housing market and the expectation that home prices will continue to rise. Homeowners build equity from both appreciation as well as reducing principal with each payment made. These same factors exist for investors of rental homes in predominantly owner-occupied neighborhoods. Real estate has another dynamic working to produce favorable investment results due to leverage. Leverage occurs when borrowed funds are used to control an asset. When the borrowed funds are at a lower rate than the overall investment results, positive leverage occurs which can increase the yield from an all cash investment. Gold and savings accounts must be funded with cash. The maximum borrowed funds allowed for stocks is 50% and generally, at a rate higher than typical mortgage rates. Homes are a particularly attractive investment because you can enjoy them personally by living in them. The interest and property taxes are deductible and gains on the profit are excluded up $250,000 for single taxpayers and $500,000 for married taxpayers filing jointly. Many people consider an investment in a home for a rental property an IDEAL investment: Income, Depreciation, Equity Build-up & Leverage. If you have questions or are curious about the process, contact me at [email protected] or (808) 345-6192. Invest in Equity Build-Up9/23/2019 Equity build-up could be one of the biggest advantages to buying a home. There are two distinct dynamics that take place to make this happen: each house payment applies an amount to reduce the mortgage owed and appreciation causes the value of the home to go up.

It is easy to make a projection based on the type of mortgage you get and your estimation of appreciation over the time you expect to own the home. Even conservative estimates can produce impressive results. Let's look at an example of a home with a $270,000 mortgage at 4.5% for 30 years and a total payment of $2,047.55 payment including principal, interest, taxes and insurance. The average monthly principal reduction for the first year is $362.98. If you assume a 3% appreciation on the $300,000 home, the average monthly appreciation is $750 a month. The total payment of $2,047.55 less $1,112.98 for principal reduction and appreciation makes the net monthly cost of housing, excluding tax benefits, $934.57. If this hypothetical person was paying $2,500 in rent, it would cost them $1,565.43 more to rent than to own. In the first year, it would cost them over $18,000 more to rent. Together, the items in this example contribute over $1,100 to the equity in the home . This is one of the reasons a home is considered forced savings. By making your house payments and enjoying increases in value, the equity grows and the net cost of housing decreases by the same amount. In this same example, the $30,000 down payment grows to $133,991 in equity in seven years. While this is equity build-up, the extraordinary growth is attributed to leverage. Leverage is an investment principle involving the use of borrowed funds to control an asset. To see what your net cost of housing and the effect of leverage will have on a home in your price range, see the Rent vs. Own. If you have questions or need assistance, contact me at (808) 345-6192. AuthorRead helpful articles and real estate resources shared on behalf Realtor® Broker, BIC Jennifer R. Rhodes of Premier Island Properties LLC Archives

June 2020

Categories

All

|

|

RB-22237

|

|

RSS Feed

RSS Feed