Why Home Buying Begins with the Agent6/10/2020 It takes a team of professionals to buy a home like the lender, the appraiser, the inspector, the property insurance agent, the title officer, and others but the real estate professional may play the most critical role.

Baking bread seems so simple. There are only four ingredients: flour, salt, yeast, and water; yet, there are steps that should be followed as well as a certain sequence to get the proper results. Some people mix all of the dry ingredients before adding the hot water to activate the yeast. Other people will activate the yeast in the warm water first to allow it to "bloom." Both methods can achieve satisfactory results but one knowledgeable person needs to be in charge of the bread instead of having multiple people to be concerned with just their one ingredient or contribution like mixing, kneading, fermentation, benching, shaping, proofing or baking. Similarly, in a home purchase, the buyer's agent can be the one who puts things in the proper order and sees that no steps are missed. The buyer's agent coordinates between the other professionals with the common goal of getting the home closed on time according to the terms agreed in the sales contract. Even if a buyer has been through the process before and possibly, multiple times, the buyer's agent will most likely have far more experience because it is their job. They perform their job on a daily basis and are not personally or emotionally involved like a buyer is. Your agent understands what and when the various steps should be done and by whom. They have worked with enough of the other professionals to know who is good at their job and can offer recommendations. They have seen the things that make a transaction go smoothly and what can derail one. Experience is a great teacher, but the lesson does not have to be learned by going through it by yourself. Take the luxury of using your real estate professional's experience acquired through years of study and practice. Allow your agent to advise you and coordinate the efforts to achieve the results you are expecting and deserve. Learn more about the process and different steps by downloading the Buyers Guide

0 Comments

Rethinking Home5/27/2020 The last two months of the new normal stay at home has led many homeowners to rethink the way they live in their home. It has now become an office for working at home; a school for children; a gym to stay in shape; and a place for recreation.

The repurposing has people evaluating whether their home still meets their needs or if some changes are necessary. In some cases, adult children have moved back home, and, in others, there are parents who have moved in for the first time. Staying at home and sheltering in place is necessary but how much togetherness can one family take and how long is it going to last? Temporary is stretching into longer than expected and even when vaccines and treatments are discovered, will things really go back to the way they were? A home is a place to call your own; to raise your family, share with your friends and to feel safe and secure. Covid-19 has changed the scope of feeling safe and secure at home and may now be considered a sanctuary of safety more than ever before. Many of the chief economists in the country feel that real estate will likely lead the country out of this recession. The housing market is experiencing low inventory and has for almost a decade. Building has not kept up with demand and prices of existing homes have continued to go up; 8% over last year. With 30-year mortgage rates at close to 3.25% and prices expected to continue to rise, an investment in a home can fit your needs and show returns in satisfaction, comfort, enjoyment, and monetary value. If you are going to be spending more time in your home for all the reasons mentioned, maybe now is the time to consider finding a home that better suits your needs. It can be done in a responsible and safe manner using an online meeting with your real estate professional. Find out what is available and what the process entails to protect you and your family. Mortgage Closing Scams4/6/2020 The American bank robber, Willie Sutton, was asked why he robbed banks and his answer was "because that is where the money is." During his 40-year career, he stole about $2 million but Internet scammers are stealing many times that amount in phishing schemes preying on unsuspecting home buyers.

These crooks know where the money is because buyers have the down payment and closing costs and are expecting to transfer it to the close the sale of their home. The FBI, in their 2018 Internet Crime Report, stated victims lost over $149 million and the CFPB estimates the losses at over $1 billion as a result of fraud in real estate transactions. The scammers want to take advantage of the situation while it is still in the buyer's account. Commonly, during the closing process, scammers will send spoofed emails to homebuyers from someone they expect to hear from regarding the transaction like the real estate agent or the settlement agent. They will include false instructions for the closing funds. Following these suggestions can help to protect you and possibly, avoid scams:

If you believe you have been the victim of a phishing scheme, call your bank immediately and ask them to issue a recall notice on the money transfer. File a complaint with the FBI at www.IC3.gov and report it to your local FBI office. The Consumer Financial Protection Bureau has released two documents in an effort to inform consumers about wire fraud scams that commonly occur during closings: Mortgage Closing Checklist and Mortgage Closing Scams. This is for information purposes only and should not be considered legal advice. What Buyers Can Do While Staying at Home3/31/2020 While you're isolating at home, there are things you can do to help buy a home now or in the near future. Instead of spending time surfing the Internet looking at homes, do the groundwork necessary to be able to purchase the home that you find.

*Your agent can recommend these professionals based on their experience and having worked with them in the purchase and sales of other homes. This can keep you from getting hooked-up with someone that may not be familiar with the type of home, area, or loans that you might be considering. Additional information about the buying process and things that you can be doing while you're waiting to look at homes can be found in the Buyers Guide. Shopping for a Mortgage3/9/2020 A lower rate will not only result in a lower payment, it will amortize the loan quicker. A $250,000 mortgage at 4.5% for 30 years will have a $1,266.71 principal and interest payment. At 4%, the same loan will have $1,193.54 payment saving $73.18 a month and the unpaid balance would be $1,776 lower at the end of five years.

Mortgage lenders tend to price their mortgages based on the credit score of the borrower. The higher the credit score, the lower the mortgage rate. There is an inverse relationship that the lower the credit score, the higher risk and therefore, a higher rate is needed to balance the risk. In order to get a valid rate that will be available to you with your credit score, you need to be pre-approved. The process of making a loan application before you find a home, allows the lender to verify your credit, income, and ability to repay the loan. Lenders usually only charge the cost of the credit report for this type of service. Be aware that pre-approval is not the same thing as pre-qualification which is simply a loan officer's opinion. When you shop for a mortgage with multiple lenders, the credit bureaus count them as a single credit inquiry if they are done within a two-week period. On the other hand, restrain yourself from applying for other credit such as cars, furniture or credit cards until after you have closed on the purchase of your home because those inquiries can negatively affect your credit score. The Consumer Financial Protection Bureau recommends that you let lenders know that you are shopping the mortgage for the best rate and fees. Instead of going to the Internet and Googling mortgage lenders, start with recommendations for a lender from your real estate professional. They see the good, the bad and the ugly and can save you a lot of time. Another reliable source would be from a friend who has recently purchased a home. There are lenders who bait unsuspecting borrowers with lower rates and fees into making an application and after critical time has lapsed, try to switch them to a different program. By that point, many buyers feel they don't have any choice but to accept what is offered. Another confusing factor is the way that loans are priced to the public. They are usually quoted at a rate with a certain amount of points. A point is one percent of the amount borrowed. An example would be a quote for a loan at 4.5% with 1 point or at 4% with 2.5 points. The points combined with the rate affect the yield the lender will earn, and you will pay. A simple way to make this an apple to apple comparison is to have the lender quote the loan as a "par-value" loan with no points involved. Then, the lowest rate will produce the lowest cost to you. Another way to compare loans will be to uses a financial app called Will Points Make a Difference. You can plug in the rate and points to calculate the lowest yield over a projected holding period or the full term. The lenders do not want to make it easy for you to compare. Mortgage money is a commodity and shopping will be worth the effort. Ready to start shopping? What kind of Properties are these?2/24/2020 It is the way the property is used that determines the type of property it is, not what it looks like. Based on the intent of the owner, the property could be a principal residence, income property, investment property or dealer property.

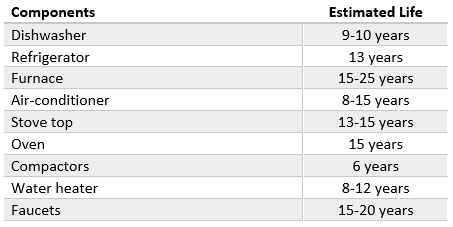

A principal residence is a home that a person lives in. There can be only one declared principal residence. It is afforded certain benefits like deducting the interest and property taxes on a taxpayers' itemized deductions, up to limits. Up to $250,000 of gain for a single taxpayer and up to $500,000 for a married couple filing jointly can be excluded from income if the property is owned and used as a principal residence for two out of the previous five years. An income property is an improved property that is rented for more than 12 months. The improvements can be depreciated based on a 27.5-year life for residential property or 39-years for commercial property. This is a non-cash deduction that shelters income. When the property is sold, the cost recovery is recaptured at a 25% tax rate. An investment property could be an improved property or vacant land that does not produce income and is not eligible for depreciation or cost recovery. The gain on both income and investment properties are taxed at a lower, long-term capital gain rate and are eligible for a tax deferred exchange. Second homes are properties that a taxpayer primarily uses for personal enjoyment but is not their principal residence. For IRS purposes, it is treated as an investment property in that the gain is taxed at preferential long-term rates if it is held for more than 12 months. However, it is not eligible for exchanges because personal use properties are excluded from that benefit. Properties that are built or bought to make a profit are considered inventory and are labeled dealer properties. The gain is taxed at ordinary income rates and they are not eligible for section 1031 deferred exchanges. The financing available differs considerably based on the intent of the owner which determines the type of property. Owner-occupied homes, used as a principal residence, are eligible for low down payment mortgages like VA, FHA, USDA and conventional ranging from nothing down to 20%. A second home, in most cases, requires a minimum of 10% down payment. Investment and Income properties, generally, require 20% or more in down payment with some possible exceptions. There is not any long-term financing available for dealer property. Anticipating the Cost of a Home12/23/2019 The largest expenditure a buyer has when purchasing a home is the down payment which can range from zero for veterans or 3.5%, 5%, 10% and 20%. With mortgages come closing costs which can be another 2-4% and must be paid at settlement in cash. Most mortgages require an escrow account to pay the property taxes and insurance when they are due. Generally, the lender will require one to three months of taxes and one month of insurance so they can be paid before the actual due date. First-time buyers should be aware that they'll need this amount of funds available to purchase a home. Unlike tenants who are not responsible for repairs, homeowners are, and it is necessary to be able to pay for them when they're needed. Newer homes will need less repairs and older homes probably, more. At some point, components like the furnace, air-conditioner and appliances will need to be replaced which could crush a homeowner's budget if they are not expecting them. Homeowners should expect between one and four percent of the value of the home in annual repairs. The age and condition of the home and whether some of the items have been replaced will help assess the anticipated expenditures. A $175,000 home with 2% estimated repair expenditures would be $3,500 a year or about $300 per month. Some years, it may not run that much and other years, it might be more. By anticipating the maintenance expenses, a homeowner is more likely to handle things when they arise.

Another way to handle the risk of unexpected repair expenses would be to purchase a home warranty. For $500 -700 a year, repairs and sometimes, replacements will be handled by the protection plan. Call me at (808) 345-6192 for a list of trusted protection plans available in our area. 7 Reasons to Buy a Home11/18/2019 Some people don't need a reason to buy a home, they just want it. That can be enough justification by itself. Other people need some solid logic before they're ready to make the commitment. The following reasons might help you to make a decision.

A bonus reason to buy a home now are the low mortgage rates available. The lowest rate recorded by Freddie Mac is 3.35% in December 2012. Today's rates are 3.75% on a 30-year fixed rate mortgage and 3.21% on a 15-year fixed rate mortgage. So, they are certainly very close to all-time lows. The highest rate on a 30-year fixed rate mortgage was 18.45% in October 1981. When you put today's rates in perspective, they are an incredible bargain. Many industry experts expect that they will not remain as low as they are now. Locking in a low rate can keep your housing costs low. A $275,000 mortgage at 3.75% for 30 years has a principal and interest payment of $1,273.57. If the rate goes up by 1%, the payment would increase to $1,434.53 or $160.96 per month for the 30-year term. Check the Rent vs. Own to see how the numbers look in your situation. Before looking for a home, you need to know how much you can afford. While you may have a number in your head, the lender has the final say. Securing a pre-approval from a lender helps make the home buying process easier and helps to avoid delays.

Many buyers confuse the terms pre-qualification and pre-approval. They mean two different things. In simple terms, a pre-qualification is an estimate of what you can afford. A pre-approval is a conditional approval based on the proof you provide. The pre-qualification is a preliminary step some borrowers take to get a feel for what price home they can afford. Based on your income, assets, and estimated credit score, lenders can estimate what you can afford. It's important to know, there's nothing binding about a pre-qualification. It's simply a starting point. When you are serious about buying a home, though, you want a pre-approval. Before you shop for a home, meet with a recommended lender to get a pre-approval letter. Sellers and/or Realtors value this letter because it shows you are likely to secure the necessary financing and serious about buying a home. Lenders meet with you in person to create the pre-approval. You'll provide the lender with all the following:

Lenders evaluate the documents and determine your conditional approval. The letter will state the mortgage amount you qualify for, the loan's terms, and any conditions the approval is contingent upon. Normally, final approval is contingent on a fully executed sales contract of the property to be purchased, a satisfactory appraisal and clear title on the property. Once a purchase contract is signed, the lender completes the underwriting on your loan. They will confirm that the property meets the necessary requirements. The lender will also re-confirm your income, assets, employment, and credit information before closing on the loan. Securing a pre-approval prior to beginning the home buying process will give you confidence and can help your negotiations with the seller. Your REALTOR® can provide you more information in an Buyers Guide and recommendations of trusted lenders. A Good Time to Buy a Home10/28/2019 You may have noticed that REALTORS® seem to always think now is a good time to buy and they can usually justify it with solid reasoning. While it can be true in general, a good time to buy has more to do with the individual than anything else. There are four things to consider. It is a good time to buy a home when you have good credit. Since the Great Recession and the housing crisis, lenders have been required to be sure that the borrowers have good credit. This actually benefits not only the lenders but the borrowers because no one wants to buy something that they cannot afford and run the risk of losing it to foreclosure. FHA has the most lenient FICO credit score of 580+. VA requires a little higher at 620 while Fannie Mae guidelines on conventional mortgages require a 700 score. It is a good time to buy a home when you have a good job that gives you the income to qualify for the mortgage and the likelihood that you'll continue to be employed in the future. Two years of steady employment in the same industry with no significant gaps is a measure that lenders consider. Lenders use qualifying ratios to make a determination. The total house payment, principal, interest, taxes and insurance, should not exceed 28% of the borrower's monthly gross income. Their total monthly debt including the house payment should not exceed 45% of monthly gross income. There is some flexibility in the ratios for the right circumstances. It is a good time to buy a home when you have the available funds for the down payment and closing costs plus a little cushion for the unexpected. The down payments can range from 0% for VA loans to 3.5% for FHA and 3% to 20% for conventional. In addition to the down payment, borrowers will have closing costs that can range from 2 to 3.5% depending on the loan type. It is possible for the seller to pay the buyer's closing costs but it needs to be negotiated in the sales contract. The lender's underwriter wants borrowers to have cash available for unexpected expenses related to the house and their normal living expenses. It is a good time to buy a home when you have stability ... In addition to employment, stability applies to not moving soon, marital status, children and unanticipated expenses. Market or economic conditions could also affect stability. So, the answer to the question "is it a good time to buy a home" depends on several things that are relative to the buyer. While it might be a great time to buy for one buyer, it may not be the best time for another buyer. Make a self-assessment to the best of your knowledge on these issues and then, schedule an appointment for a live interview with a trusted mortgage professional to get their opinion based on what underwriting will look at. Call me at (808) 345-6192 if you'd like a recommendation. After you determine it is a good time to buy a home, it is time to meet with your real estate professional. Ready to buy a home?

AuthorRead helpful articles and real estate resources shared on behalf Realtor® Broker, BIC Jennifer R. Rhodes of Premier Island Properties LLC Archives

June 2020

Categories

All

|

|

RB-22237

|

|

RSS Feed

RSS Feed